-

What Every Physician Needs to Know About Medical Malpractice Insurance

When a medical malpractice lawsuit is filed, the odds are actually in the doctor’s favor. However, this is often cold comfort for a dedicated healthcare professional who has just been served with a notice of the complaint. It’s always best to be prepared and solid preparation involves having a strong healthcare liability insurance policy. If you’re in the market for a new policy or it’s been a while since you’ve reviewed the terms of your current policy, you may need to brush up on some basic insurance terms and concepts. Remember to contact a malpractice insurance agency near Miami if you have questions.

Liability Limits

When reviewing your policy or selecting new coverage options, always check the liability limits. For locum tenens insurance policies, the usual limits are one million per incident and three million for the life of the policy. The former is often referred to as the “individual limit,” while the latter is typically known as the “aggregate limit.”Modified Occurrence Policies

You probably already understand the differences between claims-made hospital malpractice insurance and occurrence coverage. Occurrence policies cover all claims made that stem from incidents that took place during the life of the policy, while claims-made policies only provide coverage while the policy is active. But did you know that there’s a hybrid policy? You might select healthcare liability insurance in the form of a modified occurrence policy. This means that you’ll have coverage on a claims-made basis. However, the policy also includes an Extended Reporting Period (ERP), commonly referred to as a “tail.” This tail will expire after a set period, which begins at the expiration of the policy. Often, the period is seven years. Sometimes, the healthcare professional may be able to purchase an unlimited ERP upon the expiration of the initial ERP.Policy Exclusions

It’s always a good idea to fully understand your coverage exclusions. The policy exclusions for healthcare liability insurance are fairly standard. Policies do not typically cover claims that arise from illegal conduct, records alteration, or sexual improprieties. Exclusions also tend to apply when items have been misrepresented on the policy application. If your policy contains additional exclusions that you’re unfamiliar with, contact the healthcare liability insurance company for clarification. -

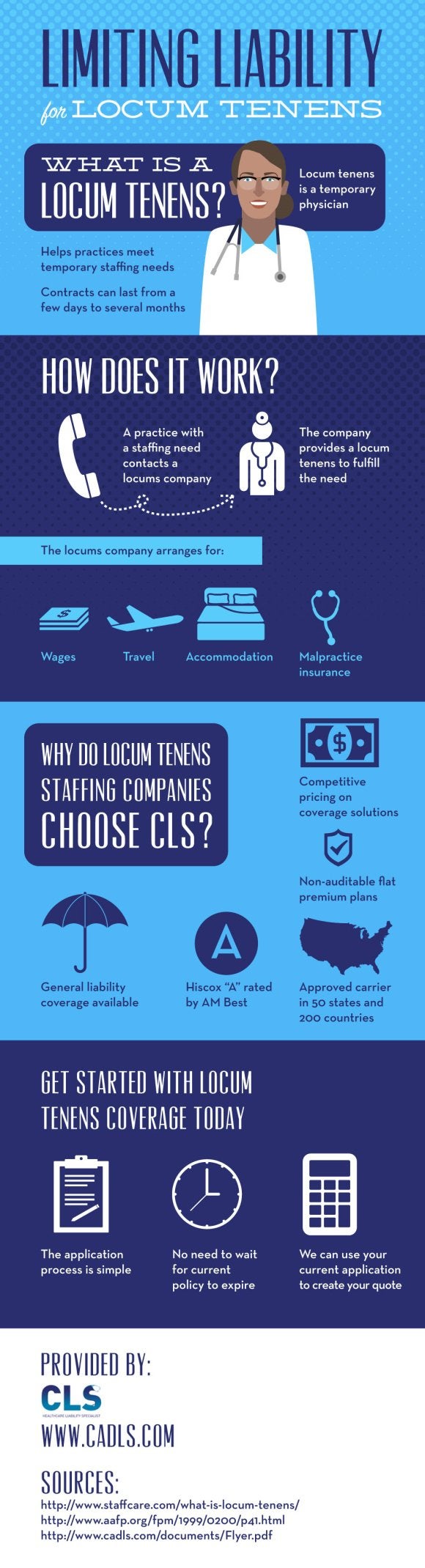

Limiting Liability for Locum Tenens [INFOGRAPHIC]

For physicians, being a locum tenens can open many doors. These temporary positions allow physicians to have flexibility and travel to work in new locations. While there are many upsides to being a locum tenens, having the right professional liability protection is critical. Since traditional medical malpractice insurance doesn’t typically cover locum tenens work, professional liability insurance is usually provided to the temporary physician by the agency that placed him or her in the position. Where do locum tenens companies get their insurance? Find out in this infographic from CLS Healthcare Liability Specialists , a provider of professional liability insurance in Miami. We’re a national leader in meeting the unique insurance needs of medical professionals, from locum tenens insurance to urgent care malpractice insurance. Contact us to discuss your company’s insurance needs and to get a simple quote, and please share this information about our highly rated coverage and affordable premiums with others in the healthcare field.

-

How to Choose Professional Liability Insurance

When choosing professional liability insurance , many healthcare professionals primarily consider their premium payments and the limits of their coverage. Whether or not professional liability insurance in Palm Beach is affordable and comprehensive are certainly important factors in the decision making process. Yet, some healthcare providers may not fully read and understand the other provisions of their policies before signing on the dotted line.

Understanding Defense and Indemnity

A healthcare liability insurance policy will include the responsibilities of the insurance carrier , which involve a duty to defend and indemnify. This means that the insurance carrier is responsible for retaining a lawyer when a med-mal claim is filed. The legal expenses are the responsibility of the carrier. The duty to indemnify means that medical malpractice insurance companies are required to pay any settlement or judgment resulting from that claim, up to a certain limit specified in the policy. Often, an insurance carrier will respect the preferences of the healthcare provider with regard to which particular medical malpractice lawyer is retained. However, this is not necessarily the case all the time. If choosing your own lawyer is important to you, review the assignment of counsel clause in your policy.Choosing Coverage for Proceedings Involving a State Board

Healthcare providers are subject to considerable oversight. In addition to facing aggressive litigation efforts by med-mal lawyers, providers may sometimes become the subject of an investigation by the State Board of Medical Examiners. Not all healthcare liability insurance policies provide coverage for legal representation in these situations. Consider whether it’s in your best interests to choose a professional liability insurance policy that does provide this type of coverage.Evaluating Settlement Provisions

It’s only natural for healthcare providers to interpret med-mal lawsuits as personal affronts; after all, their quality of care is being called into question. As a result, many physicians are reluctant to agree to a settlement deal, particularly considering that both settlements and adverse judgments are reported to the National Practitioner Data Bank. It’s important to review the consent clause of an insurance policy before purchasing it. The consent clause may require that a physician’s consent is necessary before a settlement deal is finalized. Other policies may reserve the right of the carrier to settle over the physician’s objections.