-

Tips for Avoiding Medical Malpractice Lawsuits

Most healthcare providers go into the field out of a keen desire to help others, even while they understand that medicine is a business. Still, “risk management” is not a term that one often hears at medical school. Yet, it’s an essential practice for all healthcare providers, given the unfortunate likelihood of being served with a medical malpractice complaint at least once during a career. Although having healthcare liability insurance is absolutely essential, it doesn’t protect physicians from the emotional burden that a lawsuit can inflict. After you visit a malpractice insurance agency near Palm Beach Gardens to obtain affordable malpractice insurance, take some time to consider ways of reducing your risk of a lawsuit.

Ensure Informed Consent

One way that you can reduce the risk of having to fall back on your healthcare liability insurance policy is by prioritizing each patient’s informed consent . This is particularly true of patients who are anticipating a medical procedure, whether it be brain surgery or the insertion of an IUD. Remember that there are exceptions to the standard guidelines for informed consent. If your patient is a minor, mentally disabled, or otherwise does not have decision-making capacity, you must obtain informed consent from the individual’s legal guardian or proxy.Follow Current Developments

Healthcare liability insurance companies often encounter claims made against a physician who has allegedly been negligent for failing to keep up with the latest medical research, techniques, and approaches for disease management. It’s simply impossible for healthcare providers to stay current in all areas of medicine. However, when you do have the time, you should brush up on major industry changes, particularly those that apply to your specialty.Track Follow-Up

Follow-up is another area that is rife with the potential for disputes. It’s not uncommon for a patient to be referred for imaging scans or other tests, and then for the results to be overlooked. In some cases, your office might not even receive the results at all or the patient may fail to report to the clinic for testing. Implement an effective system in your office that tracks follow-up requirements so that omissions can be detected promptly. Likewise, establish a reminder system when referring patients to specialists. If reports are not received by a certain date, your office will need to contact the specialist. -

Highlights of Our Locum Tenens Policies

For more than 25 years, CLS Healthcare Liability Specialists has been providing healthcare professionals across the country with innovative solutions for medical malpractice insurance, including locum tenens insurance in Miami. As the foremost writer of locum tenens staffing companies, it’s no surprise that we’re able to offer exclusive policies that feature non-auditable flat premiums. For busy healthcare professionals, the thought of avoiding the dreaded audit process upon the expiration of a policy is a welcome change. With our non-auditable locum tenens insurance policies, you’ll only need to provide us with your estimates without having to worry about underpayments.

Unlike many professional liability insurance carriers, our affordable malpractice insurance offers blanket additional insured coverage. There’s no need to name the specific third parties to which you would like to extend coverage. Simply provide a general description and you can rest assured that any third party claims will be covered. Healthcare professionals who turn to CLS Healthcare Liability Specialists will also find that our locum tenens policies feature extremely competitive premiums with defense costs outside available limits.

-

What Every Physician Needs to Know About Medical Malpractice Insurance

When a medical malpractice lawsuit is filed, the odds are actually in the doctor’s favor. However, this is often cold comfort for a dedicated healthcare professional who has just been served with a notice of the complaint. It’s always best to be prepared and solid preparation involves having a strong healthcare liability insurance policy. If you’re in the market for a new policy or it’s been a while since you’ve reviewed the terms of your current policy, you may need to brush up on some basic insurance terms and concepts. Remember to contact a malpractice insurance agency near Miami if you have questions.

Liability Limits

When reviewing your policy or selecting new coverage options, always check the liability limits. For locum tenens insurance policies, the usual limits are one million per incident and three million for the life of the policy. The former is often referred to as the “individual limit,” while the latter is typically known as the “aggregate limit.”Modified Occurrence Policies

You probably already understand the differences between claims-made hospital malpractice insurance and occurrence coverage. Occurrence policies cover all claims made that stem from incidents that took place during the life of the policy, while claims-made policies only provide coverage while the policy is active. But did you know that there’s a hybrid policy? You might select healthcare liability insurance in the form of a modified occurrence policy. This means that you’ll have coverage on a claims-made basis. However, the policy also includes an Extended Reporting Period (ERP), commonly referred to as a “tail.” This tail will expire after a set period, which begins at the expiration of the policy. Often, the period is seven years. Sometimes, the healthcare professional may be able to purchase an unlimited ERP upon the expiration of the initial ERP.Policy Exclusions

It’s always a good idea to fully understand your coverage exclusions. The policy exclusions for healthcare liability insurance are fairly standard. Policies do not typically cover claims that arise from illegal conduct, records alteration, or sexual improprieties. Exclusions also tend to apply when items have been misrepresented on the policy application. If your policy contains additional exclusions that you’re unfamiliar with, contact the healthcare liability insurance company for clarification. -

A Look at Medical Malpractice and Network Security

For healthcare professionals, the risk of professional liability in Palm Beach means that a comprehensive, yet affordable malpractice insurance policy is absolutely essential. However, while you’re exploring healthcare liability insurance policies, consider the potential risk for a medical malpractice lawsuit based on a breach of network security. Now that more practices have shifted to maintaining electronic health records (EHRs), the security of private patient information is more important than ever.

For a brief introduction to this issue, watch this animated video. It explains the importance of making sure your professional liability insurance would cover you in the event that a patient sues regarding an alleged breach of his or her private health information.

-

The Physician’s Guide to Medical Malpractice Insurance

The ancient Hippocratic Oath has undergone many revisions over the years, yet its basic principles remain constant. And while physicians may strive to uphold these tenets and provide the best possible care to their patients, it’s nearly impossible not to come across a disgruntled patient on occasion. Healthcare liability insurance is an inescapable component of modern medicine. Whether you’re a new resident or you’re a veteran thinking about transitioning to another practice, it is well worth your time to brush up on the basics of medical malpractice insurance . When evaluating affordable malpractice insurance in Palm Beach, consider the following factors.

Selecting a Medical Malpractice Insurer

Medical malpractice insurance companies are not all alike. Physicians generally prefer to choose an insurer that has plenty of industry experience. When you choose a company that has provided med-mal policies for several decades, you can rest assured that their customer service representatives are highly knowledgeable and can provide you with a comprehensive yet affordable medical malpractice insurance policy.Deciding Between Claims Made and Occurrence Coverage

Many healthcare providers choose occurrence policies because they provide the most comprehensive coverage for a particular policy term. In fact, whether or not a practice’s coverage is occurrence coverage may play a significant role in determining whether to accept a particular position. With occurrence coverage, a physician is covered for all claims that arise from incidents that occurred during the policy term, regardless of when the claim is filed. This means that if you had occurrence coverage from 2011 to 2014, the policy will cover a medical malpractice claim based on a 2013 incident even if it was not filed until 2015. In contrast, claims made policies only provide coverage for as long as the policy is active.Purchasing an Extended Reporting Endorsement

Even if you do choose to purchase claims made coverage, you can give yourself extra protection by purchasing an extended reporting endorsement, or tail. A tail may be purchased shortly after the cancellation of the claims made policy. It enables the insured physician to report claims despite the cancellation of the policy. -

A Look at Medical Malpractice Insurance for Emergency Physicians

Given the litigious climate of today’s healthcare field , it only makes sense for med students to give careful consideration to hospital malpractice insurance before committing to a specialty, such as emergency medicine. Although it is certainly possible to find affordable emergency medicine malpractice insurance near Miami, students should bear in mind that ER doctors typically pay more in premiums than other specialties. In fact, according to Chron, emergency medicine doctors paid a median of $20,000 in healthcare liability insurance premiums in 2011. The median for all medical specialties combined for that same year was $14,700.

However, this statistic shouldn’t necessarily alarm med students who are considering a career in the ER. Often, healthcare liability insurance is included as part of a total compensation package from the hospital. And while one might think that ER doctors are sued more frequently than other specialties, this assumption is incorrect. In addition, when ER doctors do lose lawsuits, the malpractice payoff is typically less than the average.

-

Why CLS Is the Best Choice for Your Medical Malpractice Insurance Needs

CLS Healthcare Liability Specialists is an independent agency that provides healthcare liability insurance in Miami. Our highly knowledgeable team members are pleased to serve hospitals, clinics, locum tenens staffing agencies, and individual physicians, including locum tenens physicians and surgeons. As a med-mal industry leader that provides flexible medical malpractice insurance, CLS is your best choice for liability protection.

CLS Is an Industry Leader

CLS Is an Industry Leader

Among medical malpractice insurance companies in the U.S., CLS has consistently been recognized as an industry leader. Our company is the proud recipient of numerous industry awards, including being named the #1 Writer of Locum Tenens Staffing Companies. For almost three decades, our insurance specialists have been dedicated exclusively to serving the needs of healthcare professionals .We Provide a Diverse Range of Solutions

At CLS, our emphasis is on providing creative solutions for healthcare entities that require healthcare liability insurance. When you partner with our med-mal insurance company, you’ll instantly gain access to all the insurance programs you need. Our specialists will take the time to listen to your liability concerns and learn the details of your practice. Then, we’ll match you to the right insurance policy you need at the price you want.Clients Can Take Advantage of Our Simple Quoting Process

Our medical malpractice insurance specialists understand the time constraints of today’s healthcare professionals. That’s why we’ve made it as easy and quick as possible for you to request your free quote. Simply fill out the quote request form on our website and you’ll hear back from us within 24 hours. Need an answer right away? Our knowledgeable representatives are always available to take your call.Our Dedication to Customer Service is Second to None

Speaking of our knowledgeable representatives, one of the reasons why so many physicians and staffing agencies have come to rely on our services throughout the years is because we offer the best possible customer service. Our friendly insurance specialists provide personalized attention to all prospective and current clients. We’ll answer any questions you may have, guide you through all of your coverage options, and offer recommendations that are best suited to your particular situation. -

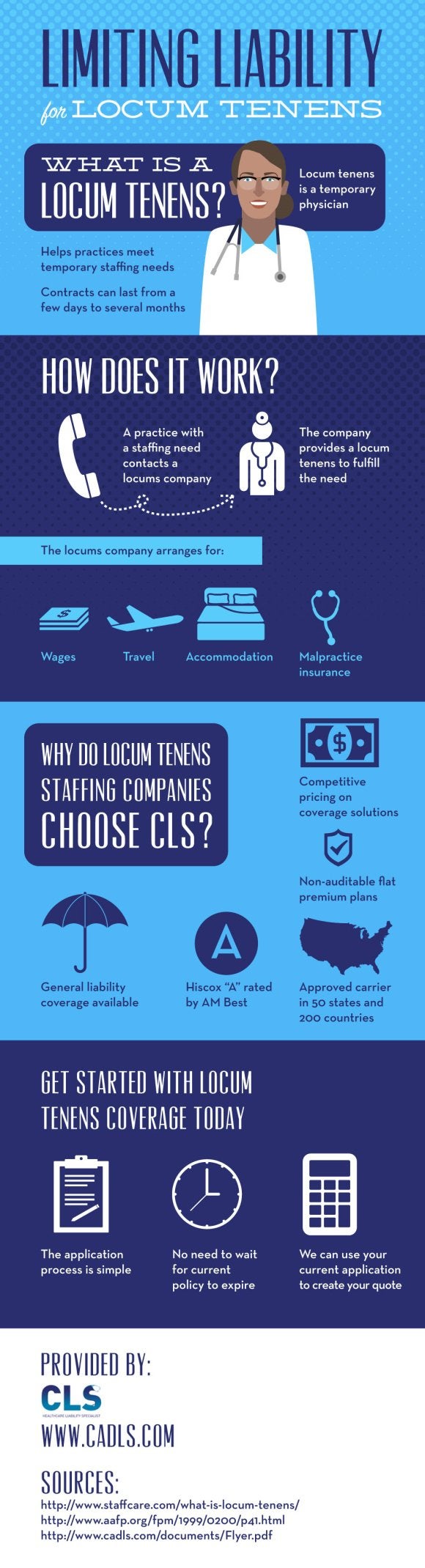

Limiting Liability for Locum Tenens [INFOGRAPHIC]

For physicians, being a locum tenens can open many doors. These temporary positions allow physicians to have flexibility and travel to work in new locations. While there are many upsides to being a locum tenens, having the right professional liability protection is critical. Since traditional medical malpractice insurance doesn’t typically cover locum tenens work, professional liability insurance is usually provided to the temporary physician by the agency that placed him or her in the position. Where do locum tenens companies get their insurance? Find out in this infographic from CLS Healthcare Liability Specialists , a provider of professional liability insurance in Miami. We’re a national leader in meeting the unique insurance needs of medical professionals, from locum tenens insurance to urgent care malpractice insurance. Contact us to discuss your company’s insurance needs and to get a simple quote, and please share this information about our highly rated coverage and affordable premiums with others in the healthcare field.

-

How to Choose Professional Liability Insurance

When choosing professional liability insurance , many healthcare professionals primarily consider their premium payments and the limits of their coverage. Whether or not professional liability insurance in Palm Beach is affordable and comprehensive are certainly important factors in the decision making process. Yet, some healthcare providers may not fully read and understand the other provisions of their policies before signing on the dotted line.

Understanding Defense and Indemnity

A healthcare liability insurance policy will include the responsibilities of the insurance carrier , which involve a duty to defend and indemnify. This means that the insurance carrier is responsible for retaining a lawyer when a med-mal claim is filed. The legal expenses are the responsibility of the carrier. The duty to indemnify means that medical malpractice insurance companies are required to pay any settlement or judgment resulting from that claim, up to a certain limit specified in the policy. Often, an insurance carrier will respect the preferences of the healthcare provider with regard to which particular medical malpractice lawyer is retained. However, this is not necessarily the case all the time. If choosing your own lawyer is important to you, review the assignment of counsel clause in your policy.Choosing Coverage for Proceedings Involving a State Board

Healthcare providers are subject to considerable oversight. In addition to facing aggressive litigation efforts by med-mal lawyers, providers may sometimes become the subject of an investigation by the State Board of Medical Examiners. Not all healthcare liability insurance policies provide coverage for legal representation in these situations. Consider whether it’s in your best interests to choose a professional liability insurance policy that does provide this type of coverage.Evaluating Settlement Provisions

It’s only natural for healthcare providers to interpret med-mal lawsuits as personal affronts; after all, their quality of care is being called into question. As a result, many physicians are reluctant to agree to a settlement deal, particularly considering that both settlements and adverse judgments are reported to the National Practitioner Data Bank. It’s important to review the consent clause of an insurance policy before purchasing it. The consent clause may require that a physician’s consent is necessary before a settlement deal is finalized. Other policies may reserve the right of the carrier to settle over the physician’s objections. -

The Latest Statistics Regarding Nurses and Medical Malpractice Claims

Quite often, nurses are the frontline responders to a patient crisis. Even when a nurse is utterly devoted to upholding the standard of care, he or she can easily be a target of a medical malpractice lawsuit filed by a dissatisfied patient. One quick look at the latest nursing medical malpractice statistics verifies the critical importance of working with a malpractice insurance agency near Palm Beach to obtain comprehensive healthcare liability insurance . For nurses who plan to work for a medical staffing agency, reviewing the locum tenens insurance policy is essential.

Advanced Practice Registered Nurse (APRN)

Advanced practice registered nurses are at the height of their profession, with the master’s or doctoral degree to prove it. Despite their advanced knowledge and highly specialized skillset, APRNs are a frequent target in med-mal lawsuits. According to the National Practitioner Data Bank (NPDB), there were 3,546 APRNs in the U.S. from 2003 to 2013. During the same time period, there were 1,458 adverse actions taken against APRNs, along with 2,791 med-mal payments. The state with the highest number of medical malpractice payments for this category of healthcare professional was Florida, at 382.Licensed Practical Nurse (LPN)

During that same time period, the NPDB reported that there were 49,543 licensed practical nurses (LPNs) in the U.S. and a total of 67,368 adverse actions taken against LPNs. However, 10,579 LPNs were reinstated and the claims only resulted in 399 medical malpractice payments.Registered Nurse

Many individuals who aspired to the healthcare profession chose to become registered nurses (RNs) because of the favorable job outlook, the growth potential, and the lucrative compensation. In fact, from 2003 to 2013, the NPDB reported 70,145 RNs in the U.S. However, during that same time period, a significant number of adverse actions were taken. The NPDB reports 100,709 adverse actions and 3,743 medical malpractice payments. Although the highest number of medical malpractice payments involving RNs was 873 in New Jersey, it’s critical for RNs and other healthcare providers to obtain affordable malpractice insurance wherever they practice.